Mainstream View on Trading: Reward-to-Risk Ratio Over Win Rate

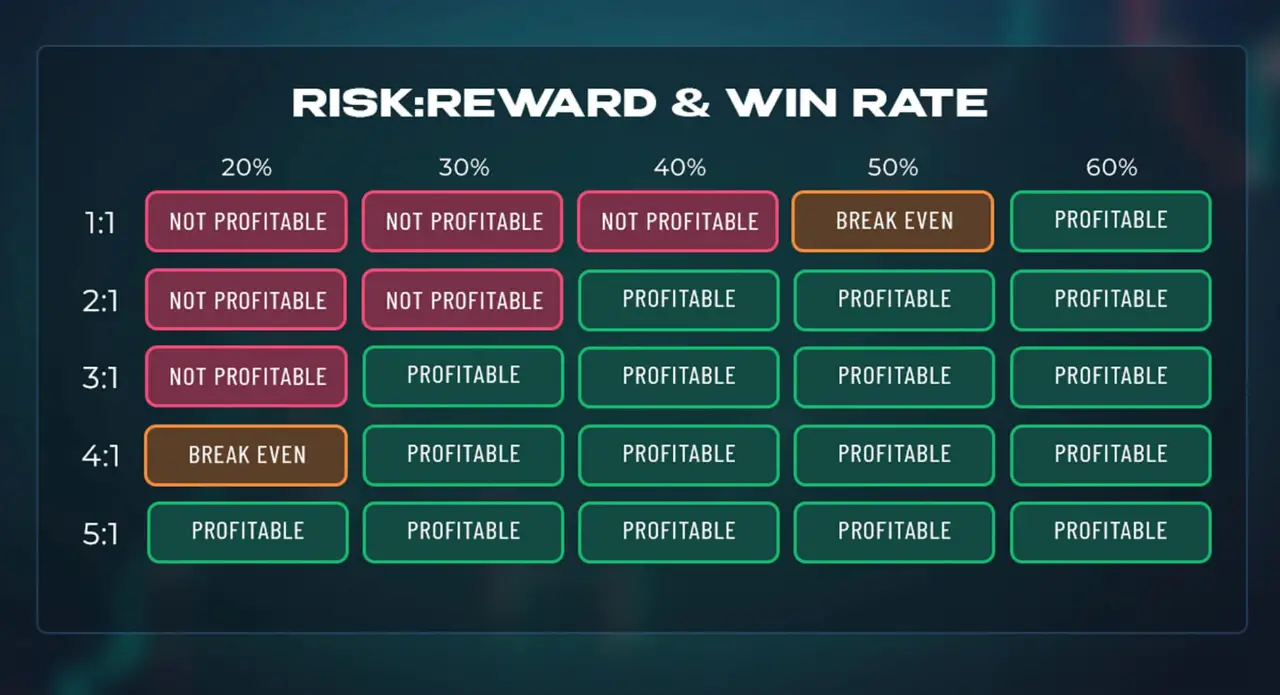

Popular articles, tutorials, and even books generally argue that the Reward-to-Risk Ratio (RR) is more important than the win rate.

They often provide a table illustrating how even with a win rate as low as 40%, one can still be profitable and achieve a positive expected value when coupled with a 2:1 RR.

I initially agreed with this viewpoint, until I started participating in prop firm challenges in recent months, where the need for consistent profitability made me realize that prioritizing the reward-to-risk ratio might not be the only absolute truth in the trading game.

Of course, these are just my own thoughts, and they're likely quite biased, with no real data to back them up.

Win Rate vs. Reward-to-Risk: Truly Two Sides of the Same Coin?

Popular discussions often pit win rate and reward-to-risk ratio against each other, as if they are mutually exclusive. However, much like the two sides of a coin, win rate and reward-to-risk are actually interdependent. In fact, I believe that "high win rate strategies" can also achieve "high reward-to-risk" results.

Articles on trading theory invariably cite the following expected value (EV) equation:

EV = (Win Rate × Average Win) - (Loss Rate × Average Loss)

Here, we have three variables:

- Win Rate (Loss Rate)

- Average Win

- Average Loss

Popular discussions often assume that “high win rate strategies” are invariably accompanied by a 'low reward-to-risk ratio'. And to improve the Expected Value (EV), they suggest 'setting' the reward-to-risk ratio to a level of 2:1 or even 3:1.

However, these are actually three independent variables.

- “Win Rate” reflects the trader's understanding of the market.

- “Average Win” reflects the trader's level of greed.

- “Average Loss” reflects the trader's discipline in executing risk management.

I believe that as long as these three variables are well-managed, a positive Expected Value will inevitably result.

As a Scalper, My Contrarian View: Win Rate Reigns Supreme!

As a scalper, my expectation is to be consistently profitable.

The key to consistent profitability is actually quite simple: harvest the low-hanging fruit.

High reward-to-risk ratio trades are very tempting, but they don't come around often. Plus, you often have to endure periods of adverse price movement.

Once you're actually in the game, you quickly realize that achieving even a 2:1 reward-to-risk ratio trade is quite difficult. The market doesn't just jump from point A to point B; it moves back and forth. The higher the RR, the longer the price needs to run, and price movements rarely go directly to their target in one straight shot. You'll very likely have to 'weather the storm' of price fluctuations

It's really tough to sit there and watch your floating profit keep shrinking.

A 24-hour day can already include 2 to 3 trading sessions, and with 20 trading days in a month, that's 60 sessions. Over a year with 250 trading days, you're looking at a massive 750 sessions.

With so many trading opportunities available, your psychological state becomes more crucial than your technical skills. There's no need to chase that perfect "holy grail" trade; instead, a steady, gradual growth each day is the optimal approach.

The Benefits of Executing High-Probability Strategies

1. A Good Win Rate Indicates Your Strategy Has an Edge.

To achieve consistent profitability, the prerequisite is having a profitable strategy. When specific conditions arise, similar outcomes are highly likely to repeat.

The probability of this logic (if-then-else) playing out reflects the depth of your market observation.

2. A Good Win Rate Helps Build Confidence.

When a strategy with an edge is in sync with the market, the probability of experiencing a long losing streak is lower, and feelings of frustration won't arise easily.

Consider this:

“If you strictly execute your strategy and havesix consecutive winning trades, would you still have the confidence to take the seventh?”

“If you strictly execute your strategy and havesix consecutive losing trades, would you still have the confidence to take the seventh?”

The difference between the two scenarios is significant!

3. A Good Win Rate Helps Maintain Psychological Stability and Adherence to Rules.

When your mind is stable, you'll also have an improved thought process when facing setbacks.

Don't see any trading opportunities right now?

My current thought process: “Let the price action develop a bit more. I know a setup will form in the next session. No need to force things.”

Got stopped out today?

My current thought process: “According to my strategy, the market has a 65% chance of moving in the anticipated direction. Did I miss something when analyzing? Or is there a better risk management technique I could use?”

Had two losing trades in a row today?

My current thought process: “Did I overlook something in my analysis? I have a 65% win rate. Let the price action develop further, then look for another setup. No need to force things.”

A trend is just starting, I should aim for a bigger target!

My current thought process: “My goal is consistent profitability. Let me take partial profits at the nearest target first, complete today's objective, and then leave a small position open to see if it reaches the larger target.”

4. A Good Win Rate Helps Control Risk, Reduce Average Loss, and Ultimately Improve RR.

Even if the “planned reward-to-risk ratio” for each trade is only 1.3:1 or even 1:1, as long as risk control is strictly implemented and the average loss is minimized, you can still achieve a 'real reward-to-risk ratio' of 3:1 or 4:1.

This byproduct, in turn, reinforces my trading concept of prioritizing the “win rate”.

In Closing

Adopting a 'win rate first' or a 'reward-to-risk ratio first' approach is entirely a personal choice. Many successful traders emphasize 'reward-to-risk ratio first,' and they are often raking in significant profits.

Because I'm focused on consistent profitability, I've recently realized that a 'win rate first' concept is the most suitable trading approach for me, especially within prop firms.

My strategy is to take profits when the price reaches the nearest target. The result has been an increased win rate. And by strictly implementing risk control, I strive to minimize the size of my losses, which ultimately allows the Actual RR to remain at a respectable level. Win rate first, strict risk control, with the reward-to-risk ratio being a byproduct.